Gift Tax Exclusion For 2024 – But you will not be subject to tax until your excess cumulative gifts exceed the lifetime estate and gift exemption. For example, suppose you gifted $25,000 to a family member in 2024. Your excess . Few people know when they must, or should, file a gift tax return. That can cost them and their heirs a bundle. .

Gift Tax Exclusion For 2024

Source : smartasset.com2024 Gift, Estate, and GST Inflation Adjusted Numbers Topel

Source : topelforman.comWhat will the estate and gift tax exclusions be in 2024, 2025?

Source : www.zelllaw.com2024 Annual Gift and Estate Tax Exemption Adjustments

Source : josephlmotta.comGift Tax Exclusion Increases for 2024: How to Get the Most Benefit

Source : www.cpapracticeadvisor.com2024 Updates to the Lifetime Exemption to the Federal Gift and

Source : www.mblawfirm.comIRS Gift Limit 2024, Spousе & Minors, Tax Free Gift, Tax Rates

Source : ncblpc.orgMonthly Technical Newsletter NAEPC

Source : www.naepc.orgFederal gift tax annual exclusion: What to do when giving monetary

Source : www.linkedin.comGift Tax Limit 2024 Exemptions, Gift Tax Rates & Limits Explained

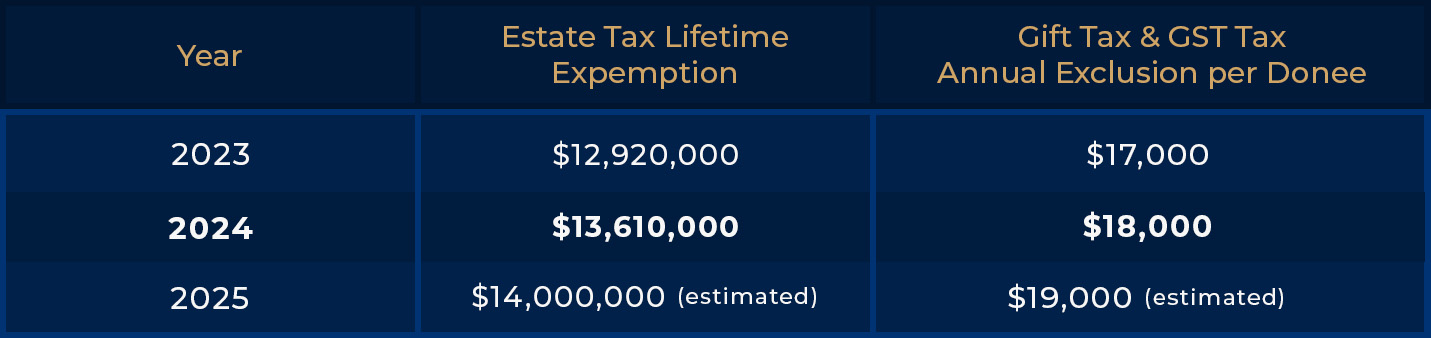

Source : cwccareers.inGift Tax Exclusion For 2024 Gift Tax, Explained: 2024 Exemptions and Rates | SmartAsset: For 2024, the estate and gift tax exemption is $13,610,000 per person. That means any one person can give during their lifetime or at their death a total of $13,610,000 without incurring gift or . For 2024, the standard tax deduction for single filers has been raised to $14,600, a $750 increase from 2023. For those married and filing jointly, the standard deduction has been raised to $29,200, .

]]>